Market Design for a Carbon Neutral Power System

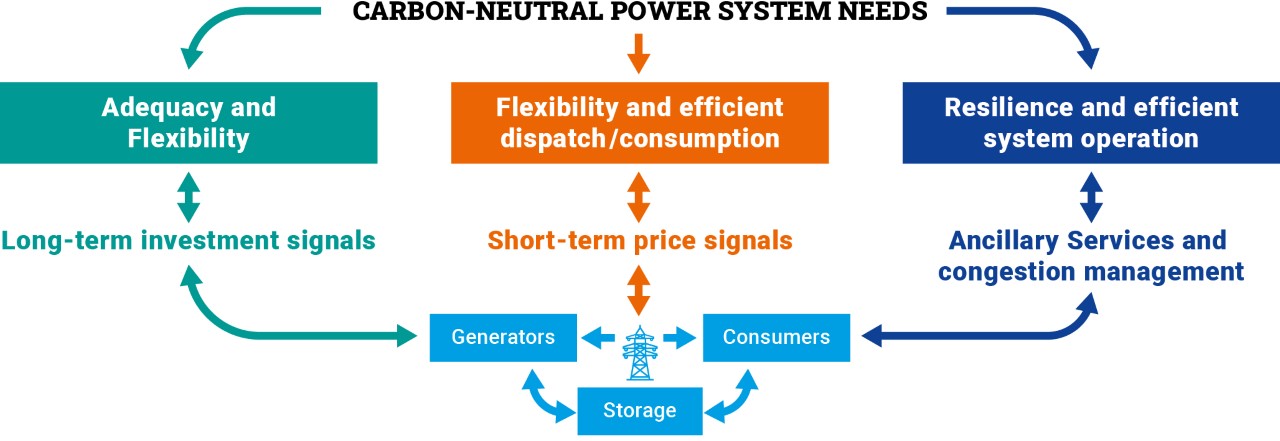

To accelerate the transition to carbon neutrality, electricity markets will need to efficiently facilitate the solutions identified in the previous chapters.

In particular, well-designed electricity markets will need to :

- enable the necessary investments in renewables, flexibility resources, and grid development across the whole value chain via effective long-term signals;

- incentivise efficient dispatch and consumption of resources, while stimulating flexibility of the whole energy System of Systems across time, space and sectors boundaries; CARBON-NEUTRAL P

- facilitate the operation of stable and reliable electricity grids by ensuring that any incentives for market parties are consistent with the physical network capabilities and overall system security requirements;

- deliver sustainable and affordable power to consumers as well as a wide range of retail offers and engagement opportunities.

While the present market design has already brought substantial benefits for Europe, the challenges of a carbon free energy system can be met only if significant changes are completed in a timely manner. At the same time, it is also of crucial importance to continue operating in a stable, transparent and forward-looking regulatory framework, so to increase investors’ confidence.

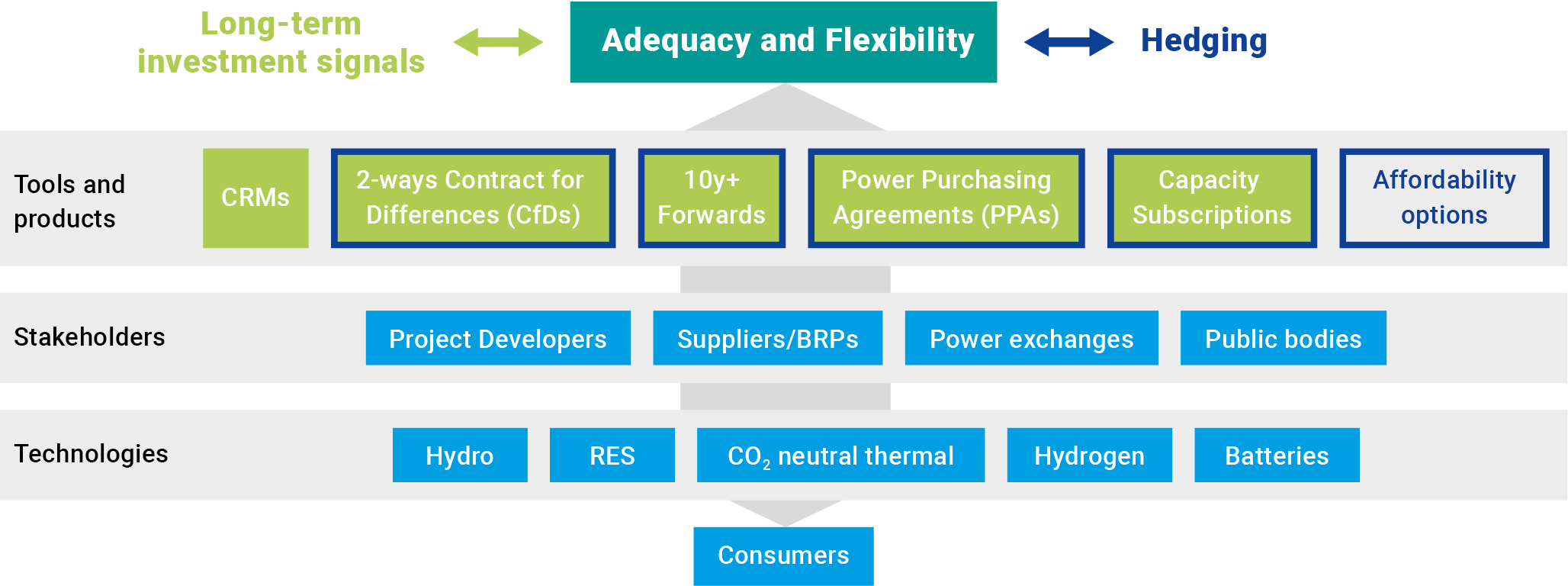

Strengthening long-term signals to deliver investments in renewables, adequacy and flexibility

The key challenge for resource adequacy is to stimulate the necessary investments in renewables and complementary flexibility resources. Given the scale of the investment challenge and the need to radically transform the power system in a relatively short period of time, there is a need for stronger long term investment signals. Reduced uncertainty on future revenue streams will reduce capital costs which are essential for capex-intensive investments in flexibility resources and carbon-neutral generation technologies. For this purpose, the regulatory framework should facilitate markets to develop liquid long term hedging products and increase the access to long-term bilateral contracts such as Power Purchase Agreements (PPAs). As these types of contracts are currently not liquid enough or accessible to all parties, introducing market making requirements or forms of public guarantees are potential solutions to be considered to facilitate their use. Hedging instruments are essential not only for generators but also for consumers to limit their risk exposure. Alongside PPAs, Affordability Options – where public authorities enter into long term contracts on behalf of certain groups of consumers – can protect against long-lasting extreme prices while providing revenue stability for generators.

Renewables support mechanisms, where necessary, need to be driven by cost-effectiveness and allow for efficient integration of the supported units in the wholesale and ancillary services markets. Two-way Contract for Differences (CfDs) can also be an effective instrument to limit generator revenues in times of high prices, but need to be carefully designed – for instance by remunerating availability rather than output.

Electricity markets need to value capacity – and its contribution to resource adequacy – much more than today. A system dominated by weather dependent generation without large scale long-duration flexibility will inevitably be exposed to periods where these resources are insufficient to cover demand. Therefore, some form of additional capacity remuneration mechanisms to ensure timely investments in back-up and / or dispatchable generation are likely to be a key feature of many European markets. Finally, in the future it should become possible to define resource adequacy levels in a more sophisticated and customised manner for more flexible consumers capable and willing to reduce their consumption during scarcity situations, e. g. by introducing Capacity Subscription as further discussed below.

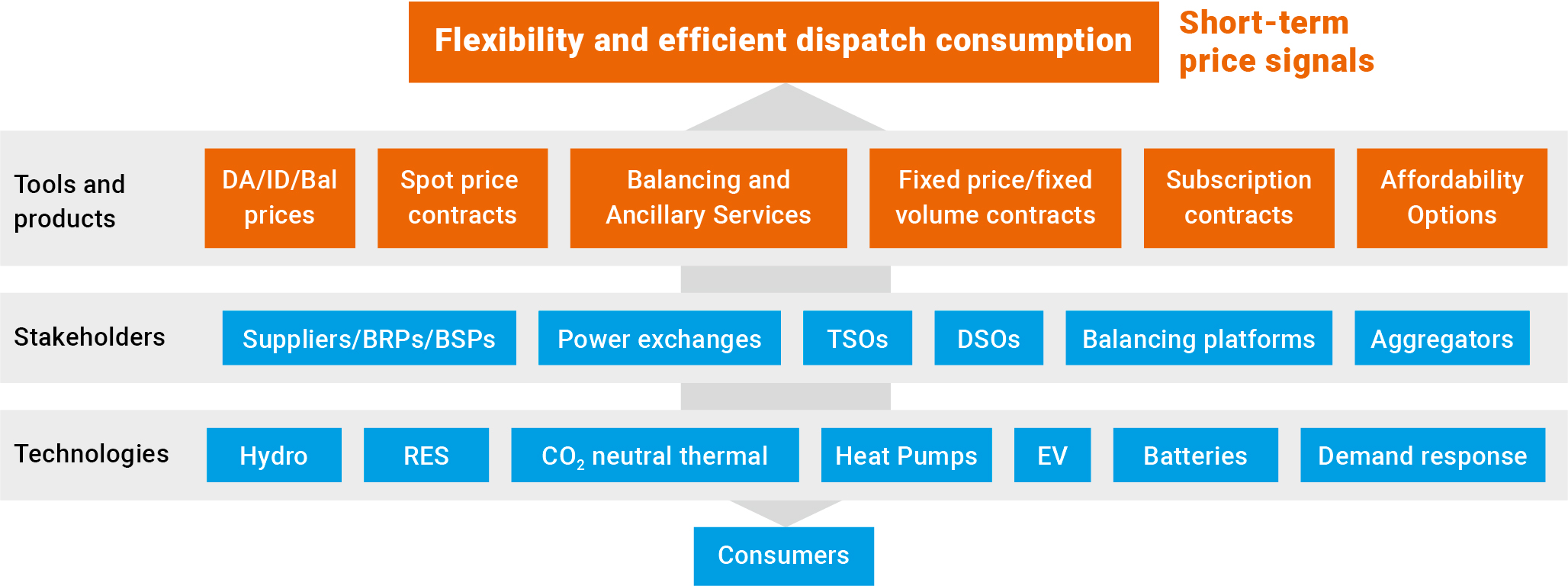

Optimise short-term markets to enhance flexibility in the future System of Systems

To increase short duration flexibility of the energy system, day-ahead, intraday and balancing price signals will be essential to ensure an efficient dispatch of generation and consumption, optimising the integrated energy System of Systems. To match the needs of the future mix of flexibility resources, short-term markets will need to progressively operate closer to real time, adopt shorter settlement periods, remove barriers to market entry and value stacking.

Electricity markets should be designed in close cooperation with all actors of the future energy System of Systems. The goal is to ensure seamless market interfaces and system optimisation between transmission & distribution and across sectors. Sector coupling technologies, like electrolysis, heat pumps and electric vehicles, will foster a more integrated energy system with the electricity sector in the centre. Efficient price signals will be essential to enable an optimal development of such a system as a whole, optimising the use of all energy resources across space and time. Potential distortions deriving from taxes and levies need to be minimised to ensure a level playing field between energy carriers, taking into account overall energy system costs and environmental externalities. Moreover, the market design should ensure an efficient access to decentralised energy and flexibility sources (including demand response) to be used where and when it is most beneficial.

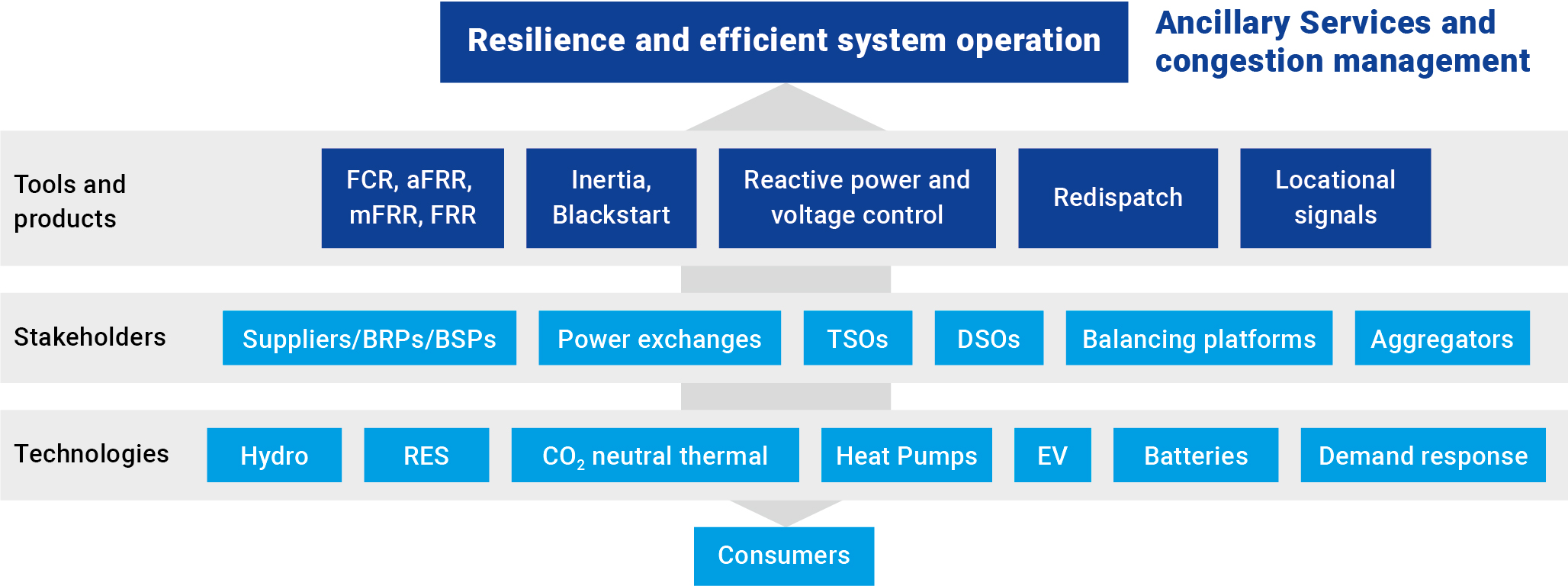

Better reflect operational challenges to facilitate efficient use of infrastructure and secure system operation.

To ensure system resilience and efficient use of infrastructure, market design needs to properly reflect grid constraints and operational challenges in a highly complex and heterogeneous System of Systems. This can be achieved via requirements, price signals and products, including new ancillary services, new congestion management approaches coordinated with DSOs, and new grid tariff structures.

Firstly, TSOs need to identify, define, quantify and communicate long-term system needs to guide market design evolutions and stimulate technology and business innovation.

Secondly, the electricity market design must be able to better reflect the physical reality of the grid. Optimal use of infrastructure limits the costs of RES curtailments and congestion management which are rising in many countries and are ultimately borne by consumers. There are several options of increasing locational price signals within the design of wholesale markets from optimal bidding zones reconfiguration, encompass dispatch hubs 1, or nodal market design (where applicable). The most efficient solution will depend on future scenarios (e. g. pace of grid infrastructure development) and on regional / national specificities. As such, different solutions may be applied across the EU while ensuring the preservation of market integration. To optimise siting of assets, locational signals may also be introduced via specific components in support schemes or capacity mechanisms. The increasing operational challenges and the rapidly changing market actors also require new products for both balancing and non-frequency ancillary services, to support for example, voltage control, inertia and fast frequency response. Close coordination with DSOs will be necessary in order to properly carry out efficient congestion management mechanisms. Lastly, it could be useful to assess how grid tariffs structures can better reflect individual grid users contributions to system costs and to operational security.

Complement price signals for efficient demand with targeted support to ensure affordability

Any future market design should not only facilitate the achievement of policy goals and support system needs, but also be in line with consumers’ needs. The identification of different preferences, promotion of new opportunities and freedom of choice will become even more important in the future. At the same time, affordability, simplicity and transparency must remain top priorities. The design of future markets will need to reflect the different values that consumers associate with their electricity, in terms of reliable capacity, flexibility, carbon footprint, vicinity of production, degree of self-sufficiency, trading possibilities. Energy communities will also become a solution to utilise local resources optimally while enhancing local engagement in the energy transition.

The recent sharp increase of average wholesale electricity prices, requires targeted policy measures to ensure energy affordability and consumer protection. Such measures should nevertheless ensure that efficient price signals for flexibility, demand response, and energy savings are not undermined. Direct consumer support measures can be complemented by several retail pricing solutions to mitigate consumers’ risks and costs increases such as fixed price contracts with fixed volumes or affordability options. Another interesting option is capacity subscriptions, which could facilitate smart load modulation during system scarcity, remunerating consumers that prefer this option, reducing overall system costs to ensure adequacy, and establishing a price for capacity based on individual consumers’ preferences.

In the longer run, the best way to reduce the impact of high fuel prices on consumers’ bills is to accelerate the development towards a power system with full carbon neutral generation and complementary flexibility, with significantly higher energy efficiency and optimised price signals.